Test Owner

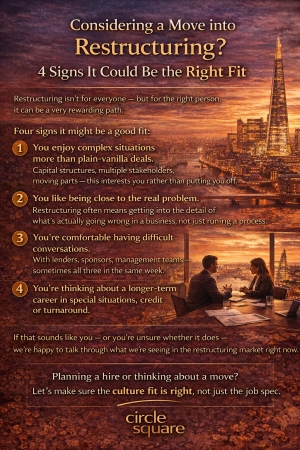

Considering a move into restructuring? 4 signs it could be the right fit

Restructuring isn’t for everyone – but for the right person, it can be a very rewarding path.

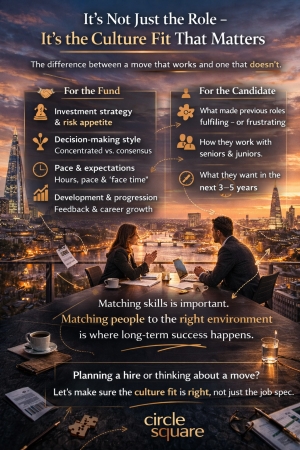

Why we spend so much time understanding a fund’s culture

- Investment strategy and risk appetite

- Decision‑making style – concentrated vs. consensus

- Expectations around hours, pace and “face time”

- Approach to development, feedback and progression

- What has made previous roles fulfilling or frustrating

- How they like to work with seniors and juniors

- What they want their next 3–5 years to look like

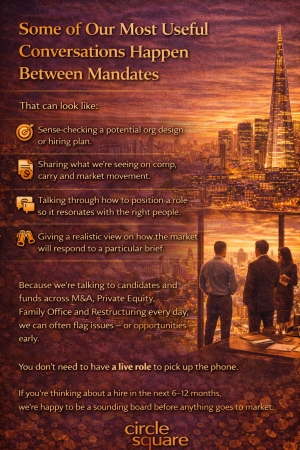

How we partner with clients between mandates

- Sense‑checking a potential org design or hiring plan

- Sharing what we’re seeing on comp, carry and market movement

- Talking through how to position a role so it resonates with the right people

- Giving a realistic view on how the market will respond to a particular brief

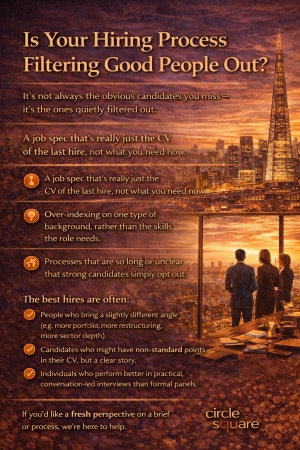

The candidates your process is missing (and why)

- A job spec that’s really just the CV of the last hire, not what you need now

- Over‑indexing on one type of background, rather than the skills the role needs

- Processes that are so long or unclear that strong candidates simply opt out

- People who bring a slightly different angle (e.g. more portfolio, more restructuring, more sector depth)

- Candidates who might have one or two non‑standard points in their CV, but a clear story

- Individuals who perform better in practical, conversation‑led interviews than formal panels

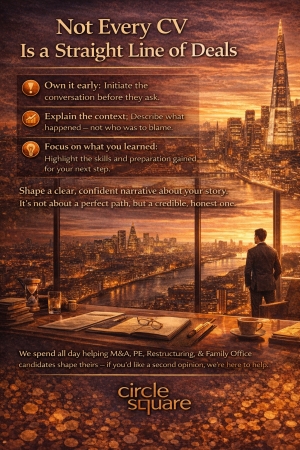

Gaps, Quiet Periods & Softer Deal Flow: How to Own Your Narrative

Not every CV is a straight line of back‑to‑back live deals.

Most hiring managers know this – but they do want a clear, confident story.

If you have a gap, a quieter period for deal flow, or slightly softer experience:

- Own it early. Don’t wait for an interviewer to drag it out of you.Explain the context – market conditions, team changes, internal moves – without blaming.

- Focus on what you learned and did during that time (skills, responsibilities, preparation for the next step).

- Be clear about why you’re now ready for this role, not still processing the lastc one. The goal isn’t a perfect narrative – it’s a credible, honest one.

We spend a lot of time with candidates across M&A, Private Equity, Family Office and Restructuring helping them shape that story.

If this resonates and you’d like a second opinion on how you’re positioning your experience, we’re happy to help.

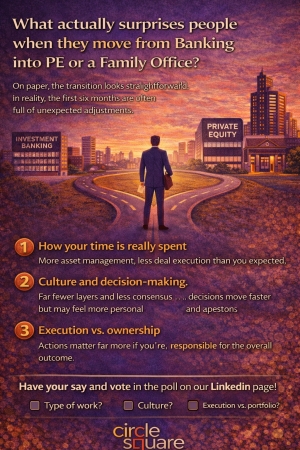

What actually surprises people when they move from Banking into PE or a Family Office?

On paper, the jump from Investment Banking into Private Equity or a Family Office looks straightforward.

In reality, the first six months often feel very different from what people expect.

We speak to candidates every week who have already made the move — and a common theme comes up:

the biggest surprises are rarely about technical skill.

They tend to fall into three broad areas.

1. How your time is really spent

Many bankers expect to spend most of their time on new deals. In practice, the mix is often very different — with far more time going into asset management, portfolio reviews, refinancing, reporting, or working with operating partners than expected.

For some people, that’s a welcome shift. For others, it feels very different from the “deal-driven” image they had in mind.

2. Culture and decision-making

Moving from a large institution into a fund — or especially into a Family Office — can be a shock to the system.

Fewer layers, more direct accountability, and far less consensus-building means decisions move faster… but they also feel more personal.

What feels like freedom to one person can feel like ambiguity to another.

3. Execution vs. ownership

In PE and Family Offices, you don’t just run processes — you live with the outcomes.

Whether it’s a lease-up, a refinancing, a bolt-on acquisition or an exit, you feel the result far more directly than you ever did in banking.

That shift in ownership is energising for many — but it’s also a big adjustment.

We’re curious to hear from people who have actually made the move.

If you’ve gone from Investment Banking into PE or a Family Office, what surprised you most in your first six months?

???? Head to our LinkedIn page to vote in the poll and (if you’re comfortable) share your experience in the comments. www.linkedin.com/company/circle-square-talent

The patterns that emerge from these conversations are often far more helpful to candidates than any job description.

Why more PE and Banking professionals are quietly exploring Family Offices

Not every good investment career has to follow the same track.

We’re seeing a growing number of bankers and PE professionals taking a serious look at Family Offices — not because they’re disillusioned, but because their priorities are evolving.

What’s driving that interest?

???? Closer proximity to capital

Working directly with principals rather than committees means ideas move faster and relationships matter more.

???? A longer investment horizon

Many Family Offices invest with generational capital, allowing for more patient underwriting and less pressure to exit on someone else’s timetable.

???? A broader mandate

Alongside direct deals, many roles include co-investments, public markets, and sometimes operating or strategic projects that wouldn’t sit inside a typical fund.

That said, Family Offices aren’t a shortcut — they’re simply a different path.

The things that matter most in FO careers are often underestimated:

• Alignment with the principal — values, risk appetite, and how decisions get made

• Comfort with fewer layers — less structure, but more personal accountability

• A quieter profile — but often with greater influence on capital and strategy

At Circle Square, we spend a lot of time helping candidates compare PE, Family Office, and other alternatives — not from theory, but from live hiring mandates and real conversations with principals.

If you’re starting to think about what the next 5–10 years of your career should look like, we’re always happy to share what we’re seeing — off the record and without any pressure.

Banking to buyside: the 5 CV tweaks that actually matter

If you’re moving from banking to the buyside, your CV doesn’t need to be clever – it needs to be clear.

Five tweaks that make a real difference:

1️⃣ Lead with deal experience, not responsibilities.

List 3–5 key transactions with your role, size, sector and outcome.

2️⃣ Be explicit about what you owned.

Did you run a workstream, build the model, lead parts of DD? Say so in plain English.

3️⃣ Quantify where you can.

If you helped drive a process to signing in 8 weeks, or supported multiple live deals at once, make that tangible.

4️⃣ Cut the jargon.

Your reader knows the technical language – they just don’t want to work to decode it.

5️⃣ Keep it to two pages or less.

More pages rarely equal more impact.

We review hundreds of CVs a month across M&A, Private Equity, Family Office and Restructuring.

If you’d like an honest view on whether yours is doing you justice, we’re happy to help.

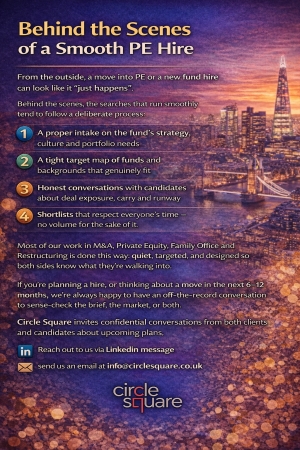

Behind the Scenes of a Smooth PE Hire

What Really Matters Most When You're Considering Your Next Move?

We often hear that compensation, title, and brand name are the top priorities when candidates start thinking about a career move.

But once we’re deep into a hiring process — having real, honest conversations — a different story often emerges.

So we’re asking:

If you had to pick just one factor that matters most to you, what would it be?

-

???? Compensation

-

???? Culture & People

-

???? Carry / Long-Term Upside

-

???? Career Progression & Learning

???? Vote now on our LinkedIn poll and let us know where you stand:

???? Click here to vote

We’d also love to hear the why behind your choice — especially if your priorities have changed over time. Drop your thoughts in the comments.