Test Owner

Redundancies in Investment Banking Staff: The Last 6 Months and a Guide to Bouncing Back

Introduction

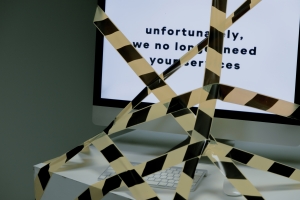

The investment banking sector has experienced a wave of redundancies over the last six months, with numerous financial institutions making cutbacks in their staff. This article will provide an overview of the major firms that have undergone reductions in their workforce and offer a helpful guide for those seeking employment after redundancy in the investment banking sector.

Major Firms and Their Redundancies

Goldman Sachs

Number of redundancies: approximately 400

Goldman Sachs announced a reduction of approximately 400 positions in their investment banking division. The firm cited a shift towards automation and digitalization as the primary reasons for the cutbacks.

J.P. Morgan

Number of redundancies: approximately 350

J.P. Morgan has reduced its investment banking staff by 350 employees, mainly affecting those in the equities and fixed income divisions. The bank attributed these changes to cost-cutting measures and increased automation.

Morgan Stanley

Number of redundancies: approximately 300

Morgan Stanley has let go of around 300 investment banking employees, primarily in the mergers and acquisitions department. The decision came as a result of a need to streamline operations and improve efficiency.

Citigroup

Number of redundancies: approximately 250

Citigroup has made 250 redundancies in its investment banking division, focusing on the fixed income and equity trading departments. The layoffs were implemented as part of the bank's ongoing efforts to optimize resources.

Bank of America

Number of redundancies: approximately 200

Bank of America has cut 200 positions in its investment banking unit, with the majority of the job losses affecting the sales and trading teams. The bank's decision was driven by a need to adapt to changing market conditions and increasing reliance on technology.

A Guide to Finding Work After Redundancy in the Investment Banking Sector

Evaluate your skillset and expertise

Take an inventory of your skills and experiences to identify your strengths and areas of expertise. Use this information to update your resume and LinkedIn profile, highlighting achievements and accomplishments in the investment banking sector.

Network with industry professionals

Attend networking events, join relevant industry associations, and leverage your existing connections to meet potential employers and gather information on job opportunities. Make use of professional social media platforms like LinkedIn to broaden your network.

Consider a sector or role change

Given the current climate, it may be beneficial to explore opportunities in adjacent financial sectors such as asset management, private equity, or financial consulting. Be open to new roles that may utilize your existing skillset in different ways.

Upskill and stay updated

Invest in your professional development by taking relevant courses, attending webinars, and earning certifications. Stay informed on the latest industry trends and news to remain competitive in the job market.

Partner with a recruitment agency

Collaborate with a recruitment agency that specializes in the financial sector. They have a comprehensive understanding of the job market and can help connect you with suitable opportunities.

Conclusion

The wave of redundancies in the investment banking sector over the past six months has undoubtedly created challenges for many professionals. However, by being proactive, adaptable, and resourceful, individuals affected by these cutbacks can successfully find new opportunities and secure their future in the industry.

The Evolution of M&A Investment Banking Recruitment: An 18-Month Retrospective

Introduction

The world of mergers and acquisitions (M&A) investment banking has seen significant changes over the last 18 months, driven by a variety of factors including technological advancements, global economic shifts, and a post-pandemic reality. As such, the recruitment landscape has evolved, with clients seeking new skill sets and the interview process adapting to these changes. This article will explore the factors affecting M&A investment banking recruitment, the skill sets clients are currently looking for, and the ways in which interview processes have adapted.

Factors Affecting M&A Investment Banking Recruitment

Remote work and digitalisation

With the global pandemic forcing businesses to embrace remote work, the M&A investment banking sector has had to adapt to a digital-first environment. This shift has impacted recruitment strategies, with firms now open to hiring talent from a more diverse and global pool.

Economic uncertainty

Fluctuating economic conditions have led to increased M&A activity in certain industries as companies look to consolidate resources, acquire competitors, or divest non-core assets. As a result, the demand for skilled M&A investment bankers has surged, prompting firms to expand their teams.

Increased competition

Growing competition in the M&A landscape has led to a battle for top talent. Investment banks are now vying for the best candidates to strengthen their teams and stay ahead in the market.

What Skill Sets Are Our Clients Are Looking For?

Technology and data analytics expertise

As M&A deals become increasingly complex and data-driven, investment banks are seeking candidates with strong technological and data analytics skills to derive valuable insights and drive the deal process.

Adaptability and resilience

In an ever-changing global economy, adaptability and resilience have become essential qualities. Candidates who can navigate uncertain situations and adapt to new challenges are in high demand.

Strong interpersonal and communication skills

M&A investment banking requires extensive collaboration with clients, colleagues, and other stakeholders. Candidates who possess strong interpersonal and communication skills are critical to ensuring seamless deal execution.

Industry-specific knowledge

With the increasing specialisation of M&A deals, investment banks are looking for candidates with in-depth industry knowledge, enabling them to provide tailored advice and insights to clients.

Adapting the Interview Process

Virtual interviews

The remote work environment has led to a shift from in-person to virtual interviews. This change allows firms to connect with candidates globally, increasing the diversity of their talent pool.

Digital aptitude assessments

To gauge candidates' technological and data analytics skills, firms have introduced digital aptitude tests as part of their recruitment process. These assessments help identify individuals who possess the technical expertise needed for modern M&A deals.

Case studies and simulations

To better evaluate a candidate's adaptability, resilience, and industry knowledge, investment banks have incorporated case studies and simulations into the interview process. These exercises provide insight into how a candidate would handle real-world M&A scenarios.

Conclusion

The last 18 months have been transformative for M&A investment banking recruitment. Driven by factors such as remote work, economic uncertainty, and increased competition, firms are now seeking candidates with a broader range of skills, including technological expertise, adaptability, and industry-specific knowledge. The interview process has also evolved, with virtual interviews, digital aptitude assessments, and case studies becoming integral components of the candidate evaluation process. As the M&A landscape continues to change, investment banks must stay agile and adapt to the evolving demands of their clients and the market.

Recent Trends in the Renewable Energy Space in Investment Banking Top 5 Deals of the Last 12 Months

Introduction

The renewable energy sector has experienced significant growth and attention from investment banking in recent years, driven by the global push towards clean energy, technological advancements, and favourable government policies. This article will explore the current trends in the renewable energy space within investment banking, highlighting five major deals that have taken place during the last 12 months. These examples provide valuable insight into the sector's direction and the increasing interest in sustainable investments.

Deal 1: J.P. Morgan's Investment in Ørsted

In May 2022, J.P. Morgan, a leading global investment bank, announced a $400 million investment in Ørsted, a Danish renewable energy company specialising in offshore wind power. The deal aimed to support Ørsted's continued expansion into new markets, including the United States and Asia, and demonstrated J.P. Morgan's commitment to investing in clean energy solutions.

Deal 2: Goldman Sachs' Acquisition of SolarEdge Technologies

In August 2022, Goldman Sachs, a prominent global investment banking firm, acquired SolarEdge Technologies, an innovative solar energy company, for $3.2 billion. SolarEdge Technologies specialises in power optimisers, solar inverters, and monitoring systems for residential and commercial solar installations. The acquisition highlighted the growing interest in distributed energy resources and the potential for advanced technology to transform the renewable energy sector.

Deal 3: BlackRock's Investment in Array Technologies

In November 2022, BlackRock, the world's largest asset manager, announced a $1.5 billion investment in Array Technologies, a leading manufacturer of solar tracking systems. This investment aimed to support Array Technologies' expansion plans, including the development of advanced tracking systems and entry into new markets. The deal signified the increasing focus on improving the efficiency of renewable energy systems and the importance of cutting-edge technology in driving the sector forward.

Deal 4: Macquarie Group's Partnership with Mainstream Renewable Power

In February 2023, Macquarie Group, an Australian investment bank, entered a $2 billion partnership with Mainstream Renewable Power, a global renewable energy company. The partnership aimed to support the development of a diverse portfolio of renewable energy projects, including wind, solar, and battery storage systems. This partnership demonstrated the growing interest in diversified renewable energy investments and the need for a collaborative approach to drive the energy transition.

Deal 5: Morgan Stanley's Investment in Echogen Power Systems

In March 2023, Morgan Stanley, a leading global financial services firm, announced a $300 million investment in Echogen Power Systems, a clean energy technology company specialising in waste heat recovery and energy storage solutions. The investment aimed to support Echogen Power Systems' development of its innovative thermal energy storage technology, which has the potential to revolutionise energy storage and management in renewable energy systems.

Conclusion

The last 12 months have seen significant activity in the renewable energy space within investment banking, showcasing the growing commitment to clean and sustainable investments. These five deals represent various aspects of the renewable energy sector, including wind, solar, energy storage, and advanced technology. As the demand for renewable energy continues to grow and governments worldwide prioritise the transition to a low-carbon economy, we can expect to see even more innovative deals and investments in this critical sector.

The Current Trends in Real Estate Retail and Consumer Space in Investment Banking: Top 5 Deals of the Last 9 Months

Introduction

The real estate retail and consumer space has been a hotbed of activity in the investment banking sector over the last 9 months. With changes in consumer behaviour, the emergence of e-commerce, and the global pandemic's impact, the industry has experienced significant shifts. This article will explore the current trends in the real estate retail and consumer space within investment banking, highlighting five major deals that have taken place during this period. These examples provide valuable insight into the current landscape and where the industry is headed.

Deal 1: Blackstone's Acquisition of QIC Global Real Estate

In August 2022, Blackstone, a leading global investment firm, acquired QIC Global Real Estate, a prominent retail property manager and developer based in Australia. The deal was valued at $3.6 billion and marked Blackstone's continued expansion into the Asia-Pacific retail market. This acquisition gave Blackstone access to a high-quality portfolio of retail properties and further strengthened their presence in the region, demonstrating their commitment to capitalising on emerging opportunities in the retail space.

Deal 2: Brookfield Asset Management's Investment in Simon Property Group

In October 2022, Brookfield Asset Management, a leading global alternative asset manager, invested $1.4 billion in Simon Property Group, the largest shopping mall operator in the United States. This investment provided Simon Property Group with the necessary capital to redevelop and repurpose several of its properties, reflecting the growing trend of transforming traditional retail spaces into mixed-use developments.

Deal 3: Goldman Sachs' Partnership with Selina

Goldman Sachs, a leading global investment banking firm, entered a $150 million partnership with Selina, an emerging hospitality and co-living brand, in December 2022. This partnership aimed to support Selina's expansion into new markets and the development of its innovative concept combining retail, hospitality, and co-living spaces. The deal highlighted the increasing interest in the convergence of different real estate sectors as a response to changing consumer preferences.

Deal 4: KKR's Acquisition of a Majority Stake in Estée Lauder's Retail Real Estate Portfolio

In February 2023, global investment firm KKR acquired a majority stake in Estée Lauder's retail real estate portfolio for $2.5 billion. This acquisition included flagship stores and premium retail properties across the United States, Europe, and Asia. KKR's investment demonstrated a growing interest in luxury retail properties, as well as confidence in the continued demand for high-end retail experiences.

Deal 5: Apollo Global Management's Merger with Kimco Realty

In April 2023, Apollo Global Management, a leading global alternative investment manager, announced a merger with Kimco Realty, a premier owner and operator of open-air shopping centres in the United States. The deal, valued at $7.2 billion, aimed to capitalise on the increasing demand for well-located, open-air retail spaces that cater to consumer preferences for convenience, experience, and a diverse tenant mix.

Conclusion

The last 9 months have showcased the evolving landscape of the real estate retail and consumer space in investment banking. These five deals represent the industry's response to changing consumer behaviours, the growing importance of e-commerce, and the impacts of the global pandemic. As the market continues to adapt, we can expect to see more innovative approaches to retail real estate investments and a focus on properties that provide unique, experiential, and convenient shopping experiences.

The Real Estate Sector in Investment Banking: Opportunities, Challenges, and Key Deals so far in 2023

Introduction

The real estate sector remains a vital part of the investment banking industry, offering a myriad of opportunities for investors to capitalize on diverse asset classes. As a foundational component of the global economy, real estate encompasses various subsectors, including operating companies (OpCo), property companies (PropCo), infrastructure, retail, and leisure. This article delves deeper into the current landscape of the real estate sector in investment banking, highlighting several notable deals in 2023 and providing insights into the industry's future.

OpCo and PropCo

Operating companies (OpCo) and property companies (PropCo) are two distinct approaches to real estate investing. OpCos focus on managing the operations and services of real estate assets, while PropCos are primarily concerned with owning and managing properties themselves. Investment banks often provide advisory services for mergers, acquisitions, and capital raising for both OpCo and PropCo clients.

In 2023, Goldman Sachs advised on a high-profile merger between two leading hotel chains, creating a global hospitality powerhouse with an extensive property portfolio. This deal expanded the companies' geographic reach, allowing them to benefit from economies of scale and improved operational efficiency. Meanwhile, JPMorgan Chase facilitated a capital raise for a prominent PropCo, enabling the company to acquire a diverse mix of commercial real estate assets in key markets across Europe.

Infrastructure

Infrastructure investments are critical for the development and maintenance of essential services such as transportation, energy, and telecommunications. Investment banks play a pivotal role in arranging financing and structuring deals for infrastructure projects, often working alongside government entities.

A landmark deal in 2023 involved the financing of a $50 billion high-speed rail project connecting major cities in the United States. Morgan Stanley and Citigroup were among the investment banks that underwrote bonds and facilitated public-private partnerships, making the project economically viable and beneficial for all stakeholders involved.

Another significant deal saw Bank of America Merrill Lynch advise on the acquisition of a European renewable energy company, further expanding the client's renewable energy infrastructure portfolio.

Retail and Leisure

The retail and leisure sectors are integral to the real estate industry, encompassing shopping centres, restaurants, hotels, and entertainment venues. Investment banks assist in structuring and financing transactions in these sectors, such as acquisitions, development projects, and debt restructuring.

In 2023, Barclays Capital advised on the acquisition of a prominent shopping center in London by an international real estate investment trust (REIT). The deal provided the REIT with a strategic foothold in a high-growth market, while also generating attractive returns for its investors. Additionally, Deutsche Bank played a key role in the debt restructuring of a global cinema chain, which allowed the company to optimize its capital structure and continue its expansion plans.

Another noteworthy deal involved Credit Suisse, which facilitated the acquisition of an upscale resort by a major leisure company. This transaction not only expanded the leisure company's luxury offerings but also positioned it for future growth in the high-end hospitality market.

Conclusion

The real estate sector continues to offer a wealth of opportunities for investment banks, spanning diverse subsectors and asset classes. Despite challenges such as rising interest rates and economic uncertainty, the industry has demonstrated resilience, with numerous high-profile deals taking place in 2023. Investment banks like Goldman Sachs, JPMorgan Chase, Morgan Stanley, Citigroup, Bank of America Merrill Lynch, Barclays Capital, Deutsche Bank, and Credit Suisse have played pivotal roles in shaping the future of the real estate sector by providing essential advisory and financing services to clients worldwide. As urbanization accelerates and the demand for real estate assets grows, the role of investment banks in driving the industry forward will become increasingly important.

Real Estate Investment Trusts (REITs) in Investment Banking London's Market and Key Deals in the Last 12 Months

Introduction

Real Estate Investment Trusts (REITs) have become an increasingly popular investment vehicle in the world of real estate investment banking. As a unique financial instrument, REITs allow investors to gain exposure to diverse real estate assets while enjoying liquidity and transparency. This article explores the role of REITs in real estate investment banking, presents scenarios when they are used, and highlights notable deals in London's booming market over the past 12 months.

REITs: A Brief Overview

A REIT is a company that owns, operates, or finances income-producing real estate properties. By pooling resources from multiple investors, REITs provide an accessible and cost-effective means for individual and institutional investors to participate in the real estate market. REITs are required to distribute at least 90% of their taxable income to shareholders as dividends, which makes them particularly attractive for income-focused investors.

Example Scenarios for REIT Usage

Diversification

Investors seeking to diversify their portfolios can invest in REITs to gain exposure to the real estate market without directly owning or managing properties.

Income generation

Due to their high dividend payout requirements, REITs can serve as a stable income source for investors looking for regular cash flow.

Capital appreciation

Investors seeking capital appreciation can benefit from the potential growth in the value of the underlying real estate assets held by REITs.

Tax advantages

REITs enjoy certain tax advantages, as they are not subject to corporate income tax on income distributed to shareholders, thus avoiding double taxation.

Notable REIT Deals in London Over the Last 12 Months

Acquisition of a prime office building in the City of London: British Land, one of the UK's largest REITs, acquired a high-quality office building in London's financial district for £200 million. The deal allowed British Land to expand its presence in the city's prime office market and capitalise on the increasing demand for flexible office spaces.

LondonMetric Property's retail park acquisition: LondonMetric, a London-based REIT, acquired a retail park in the outskirts of London for £70 million. The acquisition expanded LondonMetric's portfolio of urban logistics assets and demonstrated the company's focus on long-term, sustainable income.

Residential REITs' investment in the Build-to-Rent sector: Several UK-based residential REITs, such as Grainger and Sigma Capital Group, have invested heavily in London's Build-to-Rent sector over the past year. These investments have contributed to the growth of purpose-built rental properties, providing high-quality housing options for London's growing population.

Conclusion

REITs have proven to be a significant force in real estate investment banking, offering investors an attractive means of accessing the property market. London, as a global financial centre and real estate hotspot, has witnessed numerous high-profile REIT deals in the past year, reflecting the growing interest in this investment vehicle. With their unique characteristics and advantages, REITs are expected to continue playing a pivotal role in the future of real estate investing, providing investors with opportunities for diversification, income generation, and capital appreciation in the ever-evolving property landscape.

Global Green Energy Deals in the Last 3 Months: A Push Towards a Sustainable Future

Introduction

The global shift towards sustainable energy is gaining momentum, with countries and companies alike focusing on renewable energy sources to combat climate change and reduce reliance on fossil fuels. In the last three months, we have witnessed several significant green energy deals and collaborations, highlighting the increasing commitment to sustainability and clean energy worldwide. This article will provide an overview of some of the most noteworthy green energy deals in recent months, which signal a promising push towards a sustainable future.

Orsted's Offshore Wind Farm Agreements in South Korea and Taiwan

Orsted, the Danish renewable energy company, has recently announced two major offshore wind farm agreements in Asia. In South Korea, Orsted has signed a Memorandum of Understanding (MoU) with the Korea Southern Power Corporation (KOSPO) to jointly develop the Incheon offshore wind project, with an estimated capacity of 1.6 GW. Meanwhile, in Taiwan, Orsted has secured a 920 MW grid capacity for the Greater Changhua 2b & 4 offshore wind farm project, further expanding its footprint in the region.

BP and EnBW's Joint Venture for UK Offshore Wind Projects

British energy giant BP and German utility EnBW have recently announced a joint venture to develop two large-scale offshore wind projects in the United Kingdom, with a combined capacity of 3 GW. The partnership marks a significant step for BP, which aims to increase its renewable energy capacity from 3.3 GW to 50 GW by 2030, as part of its broader commitment to achieving net-zero emissions.

TotalEnergies and SunPower's Solar Power Expansion in the United States

French energy company TotalEnergies and its majority-owned subsidiary SunPower have recently announced plans to expand their solar power capacity in the United States. The companies have signed a series of power purchase agreements (PPAs) for the supply of 3 GW of solar energy, with projects spread across California, Texas, and Nevada. These agreements underline TotalEnergies' ambition to become a major player in the global renewable energy market, as it aims to reach a net-zero emissions target by 2050.

ENGIE and Caisse des Dépôts' Acquisition of Eolia Renovables

French utility ENGIE and investment firm Caisse des Dépôts have jointly acquired a majority stake in Eolia Renovables, one of the largest independent renewable energy companies in Spain. With a portfolio of more than 1.7 GW of installed capacity across wind and solar projects, the acquisition bolsters ENGIE's position in the European renewable energy market and reinforces its commitment to carbon neutrality.

Conclusion

The green energy deals mentioned above showcase the growing global commitment to renewable energy and sustainability. As governments, corporations, and investors continue to prioritize clean energy solutions, we can expect to see even more ambitious projects and collaborations in the coming months and years. These recent deals represent significant progress in the transition to a sustainable future and underscore the increasing global awareness of the need for swift and decisive action to combat climate change and ensure a cleaner, greener world for future generations.

Investment Banking in the Blockchain Space: A New Frontier for Finance and Key Players

Introduction

As blockchain technology continues to disrupt various industries, its impact on investment banking is becoming increasingly apparent. Blockchain-based solutions offer significant opportunities for investment banks to streamline their operations, reduce costs, and enhance security, which has led to a growing number of financial institutions exploring and adopting this technology. This article will provide an overview of investment banking in the blockchain space, along with examples of key players, that are leading the way in this emerging market.

Blockchain technology has the potential to revolutionise several aspects of investment banking, including:

Settlement and Clearing

Blockchain can significantly expedite the settlement and clearing process, which traditionally takes several days to complete. By leveraging distributed ledger technology (DLT), investment banks can instantly verify and settle transactions, improving efficiency and reducing counterparty risk.

Trade Finance

Blockchain can streamline trade finance by providing a single, tamper-proof ledger for all parties involved in a transaction. This transparency can reduce fraud, lower costs, and increase trust among participants, leading to faster and more secure trade finance operations.

Regulatory Compliance

Investment banks are subject to numerous regulations, and blockchain can help simplify the process of maintaining compliance. By storing transaction data on a secure, immutable ledger, banks can easily provide regulators with the necessary information and ensure accurate record-keeping.

Key Players in Blockchain-based Investment Banking

Several key players are paving the way for investment banking in the blockchain space, let's take a closer look at some of these innovators:

EHaro

EHaro is a pioneer in the field of blockchain-based investment banking. The company aims to provide a comprehensive suite of financial services by leveraging the power of blockchain technology. EHaro's platform offers a range of solutions, including digital asset management, tokenised securities, and decentralised finance (DeFi) products. By combining traditional investment banking expertise with cutting-edge blockchain solutions, EHaro is at the forefront of the industry's digital transformation.

Circle

Circle, a global fintech company, offers a suite of blockchain-based financial services, including a stablecoin pegged to the US dollar (USDC) and various investment products. Circle's focus on regulatory compliance and its partnerships with major financial institutions, such as Visa, highlight the growing acceptance of blockchain technology in the investment banking sector.

tZERO

tZERO, a subsidiary of Overstock.com, is focused on revolutionising capital markets by offering a blockchain-based trading platform for tokenised securities. The platform enables investors to trade digital assets in a regulated environment, bridging the gap between traditional finance and the emerging world of blockchain.

Conclusion

Investment banking in the blockchain space represents a new frontier for finance, offering numerous opportunities for increased efficiency, security, and transparency. As key players like EHaro, Circle, and tZERO continue to innovate and expand their offerings, we can expect to see a growing number of traditional investment banks exploring and adopting blockchain technology. This shift has the potential to reshape the investment banking landscape, making it more accessible, efficient, and secure for all market participants.

Investment Banking Deals in Emerging Markets: A 3-Month Snapshot

Introduction

Investment banking deals in emerging markets have been thriving in the past three months, reflecting the growing interest and confidence of global investors in these regions. This article highlights some of the most notable transactions, their participants, and the potential implications for the economies and sectors involved.

JP Morgan's Advisory Role in the Proximo Acquisition

In a significant deal in the Latin American market, JP Morgan served as the financial advisor to Proximo, a leading Brazilian food and beverage company, in its acquisition of a majority stake in Ponto Natural, a fast-growing health food chain. This transaction illustrates the growing interest in the healthy food segment and is expected to boost Proximo's market presence while providing Ponto Natural with additional resources for expansion.

Goldman Sachs' Investment in African Fintech Company Flutterwave

Goldman Sachs participated in a funding round for Flutterwave, an African fintech firm focused on facilitating seamless cross-border payments. The $170 million Series C round led by New York-based private investment firm Avenir Growth Capital and US hedge fund Tiger Global Management, valued Flutterwave at over $1 billion. This investment reflects the increasing importance of fintech in emerging markets and underscores the potential for growth in Africa's digital economy.

Citigroup's Role in Reliance Industries' Bond Issuance

Citigroup acted as the lead manager for the $4 billion bond issuance by India 's Reliance Industries Limited (RIL), one of the largest private sector companies in the country. This bond issuance, which attracted significant interest from global investors, will help RIL refinance existing debt and fund its ambitious expansion plans, particularly in the renewable energy sector. The successful transaction highlights the growing appetite for corporate bonds from emerging market issuers and strengthens India's position as a major investment destination.

Bank of America's Involvement in the VinFast IPO

Bank of America acted as one of the global coordinators for the initial public offering (IPO) of VinFast, Vietnam's leading electric vehicle (EV) manufacturer. The IPO, valued at approximately $3 billion, represents one of the largest listings by a Vietnamese company on an international stock exchange. This milestone transaction underlines the increasing interest in sustainable technologies in emerging markets and bolsters Vietnam's reputation as a promising hub for innovation and investment.

Morgan Stanley Advising on the Merger of Two Indonesian Banks

Morgan Stanley served as an advisor in the merger of two major Indonesian banks, Bank Negara Indonesia (BNI) and Bank Tabungan Negara (BTN). This strategic deal aimed to strengthen the banks' competitive edge in the region's rapidly evolving financial landscape. As a result of the merger, the newly-formed entity is expected to become one of the largest state-owned banks in Indonesia, with an enhanced capacity to support economic growth and development in the country.

Credit Suisse's Role in Helios Towers' Expansion

Credit Suisse played a key role in Helios Towers' $450 million acquisition of Airtel Africa's passive infrastructure assets, consisting of over 3,100 telecom towers across Madagascar, Malawi, Chad, and Gabon. The deal is set to enhance Helios Towers' position as one of the leading independent telecommunications infrastructure providers in Africa. This transaction underscores the growing demand for telecom infrastructure in emerging markets and highlights the potential for further growth and consolidation in the sector.

Barclays Advising on KenGen's Green Bond Issuance

Barclays acted as the lead arranger for KenGen, Kenya's largest electricity producer, in its inaugural green bond issuance. The $300 million bond will finance the company's renewable energy projects, including geothermal, wind, and solar power generation. This marks a significant milestone for Kenya's renewable energy sector, with the green bond issuance expected to pave the way for more sustainable financing opportunities in the region.

Conclusion

The past three months have seen a surge of investment banking deals in emerging markets, spanning across sectors such as fintech, renewable energy, infrastructure, and telecommunications. These transactions signal growing investor confidence and highlight the significant growth potential in these regions. As emerging markets continue to gain prominence on the global stage, it is expected that investment banking deals will play a crucial role in driving economic growth and development in these areas.

Tech Investment Deals Shaping the Industry: A 6-Month Overview

Introduction

The last six months have witnessed an abundance of tech investment deals that have played a significant role in shaping the technology landscape. These deals have involved a diverse range of companies, investors, and sectors. This article delves into some of the most notable investment deals, exploring their participants, implications, and potential impact on the industry.

Amazon's Acquisition of Nucleai

Amazon Web Services (AWS) acquired Nucleai, an Israeli startup specialising in artificial intelligence (AI) for pathology. Nucleai's AI technology assists pathologists in diagnosing diseases more accurately and quickly. This acquisition enables AWS to expand its portfolio of AI-powered services and provides Nucleai with the resources to develop more advanced medical imaging solutions. The deal is expected to have a lasting impact on the healthcare industry by enhancing diagnostic capabilities and improving patient outcomes.

Alphabet's Investment in Sidewalk Infrastructure Partners

Alphabet, Google's parent company, invested $100 million in Sidewalk Infrastructure Partners (SIP). SIP focuses on developing innovative infrastructure solutions that leverage technology to tackle urban challenges. This investment aims to advance the development of smart cities and facilitate sustainable growth. With Alphabet's backing, SIP is poised to make significant advancements in areas such as transportation, energy, and waste management, potentially revolutionising urban living.

Tesla's Partnership with Graphex Technologies

Tesla inked a deal with Graphex Technologies, a company specialising in advanced battery materials. The partnership aims to develop next-generation batteries with higher energy density and longer life cycles. This collaboration is anticipated to solidify Tesla's position as a leader in electric vehicle (EV) technology and accelerate the adoption of EVs worldwide.

SoftBank Vision Fund's Investment in Holoride

SoftBank Vision Fund invested $75 million in Holoride, a German startup that creates immersive in-car virtual reality (VR) experiences. Holoride's technology transforms vehicle motion into real-time interactive content, providing passengers with engaging entertainment options. The investment will enable Holoride to expand its offerings, attract partnerships with automakers, and disrupt the in-car entertainment market.

Microsoft's Acquisition of Activeloop

Microsoft acquired Activeloop, an AI-driven data management platform. The platform simplifies the process of accessing, processing, and managing large-scale datasets, which is essential for machine learning and data science projects. With this acquisition, Microsoft aims to bolster its Azure cloud platform and improve its data handling capabilities. Activeloop's integration into Azure is expected to streamline workflows and enhance the platform's appeal to businesses looking for efficient data management solutions.

Cisco's Acquisition of Pensando

Cisco Systems acquired Pensando, a company specialising in edge computing technology. Pensando's Distributed Services Platform empowers organisations to manage and secure their data and applications across data centers and the cloud. This acquisition aligns with Cisco's focus on cloud and edge computing, allowing them to offer a more comprehensive solution to their customers. The deal is expected to strengthen Cisco's competitive edge and drive further innovation in the field of edge computing.

Conclusion

The past six months have witnessed a slew of tech investment deals, showcasing the rapid pace of innovation and growth in the technology sector. These deals have spanned various industries, from healthcare to infrastructure, transportation to entertainment, and cloud computing to edge computing. These investments and acquisitions not only highlight the strategic moves made by leading tech giants but also signal the potential for significant impact on the future of technology and its role in shaping our world.