Test Owner

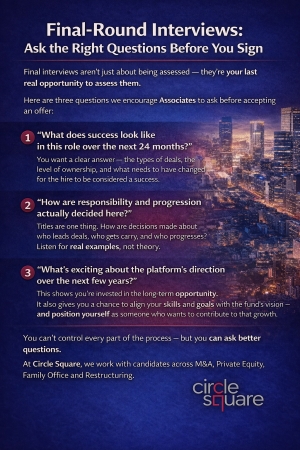

Final-Round Interviews: Ask the Right Questions Before You Sign

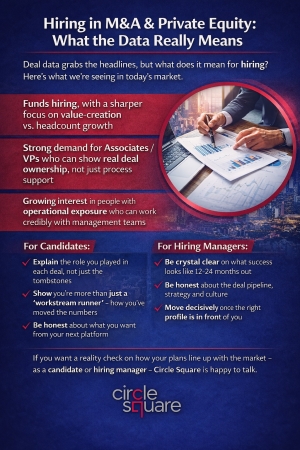

Hiring In M&A and Private Equity; What The Data Really Means

- Funds still hiring, but with a sharper focus on value‑creation vs. headcount growth

- Strong demand for Associates / VPs who can show real deal ownership, not just process support

- Growing interest in people with operational exposure who can work credibly with management teams

- Explain clearly your role on each deal, not just the tombstones

- Show how you’ve helped to move the numbers, not only run workstreams

- Talk honestly about what you want from your next platform

- Crystal clear about what success looks like 12–24 months out

- Honest about the deal pipeline, strategy and culture

- Willing to move decisively once the right profile is in front of them

Launching our PE, M&A, Family Office & Restructuring series

- What we’re hearing from funds and advisory firms about demand and deal flow

- Practical career advice for people thinking about a move (or their next move)

- Honest views on what makes a good hiring process in a competitive market

- A small number of featured, anonymised roles we’re working on

M&A, Venture & Private Equity in MENA: A Market in Motion

Introduction

There’s a quiet confidence building across the Middle East and North Africa (MENA) investment landscape. From family offices to sovereign wealth funds, venture investors to PE houses, the region is seeing a transformation — not just in capital flows, but in deal sophistication, international reach, and appetite for talent.

At Circle Square, we've been closely tracking the evolution of M&A and private capital in the region — and here’s what we’re seeing on the ground.

The Rise of Regional M&A

The last 24 months have seen a notable increase in intra-regional M&A activity, particularly in sectors aligned with national transformation plans — including tech, healthcare, education, logistics, and renewable energy.

Key drivers:

- Government-backed consolidation strategies (particularly in Saudi Arabia and the UAE)

- Cross-border appetite from listed and private companies to scale beyond home markets

- Increased advisory sophistication, with international boutiques and Big Four teams doubling down on MENA

We're seeing a steady rise in junior and mid-level M&A hiring as firms look to bolster their execution capabilities in Riyadh, Dubai, and Doha.

Venture Equity – Resilience & Reset

Venture activity in MENA is going through a natural correction phase, but it’s far from quiet. Saudi’s PIF-backed accelerators and UAE-based family offices remain active — but are increasingly focused on unit economics, governance, and scalability.

Despite the global VC slowdown, capital is flowing into:

- AI, fintech, healthtech and infrastructure-linked tech

- Series A–C stage rounds, with more structured and strategic participation

- Locally backed ventures that align with Vision 2030 and diversification mandates

This has created demand for professionals with transaction experience in both developed and emerging markets — and a hybrid mindset that can bridge start-up agility with institutional expectations.

Private Equity: Local Funds Go Global

MENA-based private equity is in a transition phase — moving from opportunistic investing to long-term platform building. SWFs like Mubadala, ADQ and PIF continue to lead the charge, often co-investing with global partners or launching thematic funds in:

- Healthcare & Pharma

- Digital infrastructure

- Consumer & retail consolidation

- Real estate and logistics

At the same time, regional funds are professionalising internally. There’s more emphasis on building permanent capital teams — origination, execution, and portfolio management — especially those with international experience and Arabic cultural fluency.

What It Means for Talent

In short, the market is maturing — and talent demand is rising fast.

We’re seeing:

- Firms hiring outside the region, with relocation packages and long-term incentive plans

- Diaspora professionals returning, often for strategic leadership roles

- Growing interest in mid-level dealmakers (Associate to VP) who bring structure, hustle, and cultural alignment

Conculsion

For candidates and firms alike, the opportunity is real — but the competition is rising. In MENA, as in other growth regions, the edge goes to those who move early, stay agile, and hire smart.

If you’re thinking of making a move to MENA, building out a deal team or want to discuss the current hiring landscape across PE, venture, or advisory, reach out to us directly on 020 7492 0700 — we’d be happy to talk through what we’re seeing in the market.

5 Questions You Must Nail in a Venture Capital Interview

Introduction

Venture capital interviews go beyond financial acumen—they test your judgment, curiosity, and ability to think like an investor. Whether you’re applying to a seed-stage fund or a multibillion-dollar growth investor, here are five questions that come up again and again—and how to approach them.

1. “What’s a startup you’d invest in and why?”

Pick a real company—not a cliché—and walk through your investment thesis. What problem does it solve? How big is the TAM? Who are the competitors? Bonus points if you’ve spoken with customers or founders.

2. “What makes a great founder?”

You’re not just backing ideas—you’re backing people. VCs look for resilience, storytelling, and domain expertise. Share examples of traits you admire, and ideally, reference founders you've met or studied.

3. “How would you source deals?”

VCs want hungry, well-networked associates. Talk about how you’d tap into founder communities, leverage data, or build your own thesis-driven sourcing pipeline. Show that you’re proactive—not just reactive.

4. “What are the risks in your investment pick?”

This is a test of self-awareness. All startups carry risk—product, team, market timing. A strong candidate doesn’t ignore red flags; they flag them early and explain how they’d mitigate them.

5. “Explain a recent VC deal you found interesting”

Pick one that suits the stage and sector of the fund. Explain the valuation, the round structure, and why the investor led it. Be ready to critique the deal too—politely and thoughtfully.

Conclusion

VC interviews are about pattern recognition and conviction. At Circle Square, we help candidates sharpen their thinking, build credibility, and tell stories that resonate with investors.

5 LBO Model Tips That Will Impress Any Private Equity Interviewer

Introduction

If you're interviewing for a private equity role, chances are you’ll face an LBO case—either in a take-home test or a live build. Technical ability matters, but so does clarity, structure, and commercial thinking. Here’s how to stand out.

1. Keep your assumptions realistic

Many candidates overestimate leverage or target unrealistic IRRs. Use current market data—realistic interest rates, exit multiples, and EBITDA growth. Smart assumptions show you understand the real world, not just Excel.

2. Simplicity wins

You don’t need a 20-tab monster model. In most interviews, a clean 3-statement model with a debt schedule, return analysis, and sensitivity outputs is more than enough. Make sure your logic is traceable and easy to follow.

3. Prioritise debt structuring

Private equity is all about leverage. Demonstrate knowledge of senior vs mezzanine, revolvers, covenants, and cash sweeps. Clearly show the impact of debt tranches on IRR and equity value.

4. Show the commercial story

LBOs aren’t just number games. Show how the company gets from entry to exit—through margin expansion, revenue growth, or cost optimisation. Articulate why the deal makes sense beyond the spreadsheet.

5. Know your returns inside out

You’ll likely be asked: “What drives the IRR?” or “What assumptions did you flex in your sensitivity?” Don’t let your model do the thinking—show you understand the levers behind the numbers.

Conclusion

LBO models are about control, clarity, and credibility. At Circle Square, we coach candidates through real-case simulations used by top PE funds—whether you’re preparing for a megafund or growth equity role.

7 Skills You Need to Succeed in a Corporate Development Role

Introduction

Corporate Development teams are small, strategic, and often high-impact. Whether you're transitioning from investment banking, consulting, or a startup, mastering the right blend of hard and soft skills is essential. Here's what hiring managers are looking for—and how to stand out.

1. Strategic Thinking

Strong Corp Dev professionals see the big picture. You’ll need to assess how M&A, partnerships, or divestitures align with long-term business objectives. Can you connect a deal to revenue growth or market expansion? That’s strategic value.

2. Financial Modelling

While Corp Dev isn’t as model-heavy as IB, you’ll still build 3-statement models, DCFs, and accretion/dilution analyses. Confidence in Excel is expected—bonus points for experience with LBOs or scenario modelling.

3. Project Management

Deals move quickly, but execution can take months. You’ll need to manage timelines, track deliverables, and align legal, tax, HR, and finance teams—sometimes across multiple geographies.

4. Stakeholder Management

Corp Dev sits at the intersection of the business. You’ll engage with senior leadership, product teams, external advisors, and even investors. Listening, translating needs, and aligning priorities are critical.

5. Commercial Acumen

Hiring managers want candidates who can think like business leaders—not just dealmakers. Can you evaluate the competitive landscape, customer value, or operational impact of a deal?

6. Communication

From board memos to target presentations, you must articulate complex ideas clearly. Whether presenting a deal rationale or explaining valuation metrics, clarity wins.

7. Adaptability

No two days in Corp Dev are the same. One day you’re building a target list, the next you're handling diligence, and then working on post-merger integration. Agility is key.

Conclusion

Corporate Development roles reward sharp minds who can blend finance, strategy, and people skills. If you’re preparing to make the jump or ready to progress to a senior position, Circle Square can help. We know what great looks like—and how to position your profile to land the right opportunity.

Private Equity Associate Salaries in London – What to Expect in 2025

Introduction

As we head into 2025, the market for private equity talent in London is competitive—especially for Associate roles. Whether you’re moving from IB, MBB, or already in PE, here’s what you need to know about compensation.

1. Base salary range

Private equity Associate base salaries in London currently range from £90k to £120k, depending on fund size and strategy. Growth and mid-market funds tend toward the lower end; megafunds and elite firms offer the higher end.

2. Bonus expectations

Bonuses vary widely but are generally 50% to 150% of base. High-performers at top funds can earn £200k+ all-in at Associate level. Funds with carry or co-investment options offer long-term upside beyond annual comp.

3. Carry & long-term incentives

Most Associates won’t see meaningful carry until they’re promoted, but some growth funds offer early-stage equity or performance-linked incentives. It’s worth asking about vesting schedules, hurdle rates, and participation structures.

4. Other perks to consider

Think beyond comp: work-life balance, team culture, sector focus, deal flow and promotion track all matter. Some firms offer flexible working, wellness budgets, or training programmes—these can add major value.

5. What’s driving salary growth?

Demand is outpacing supply. With many junior bankers switching to tech, funds are upping the ante to attract committed advisors. Specialisation (e.g., tech, infra, healthcare) can also boost your value.

Conclusion

Circle Square works closely with London’s most respected PE funds and we see real-time data on salary benchmarks, comp trends and bonus structures. If you're considering a move, we’d be happy to benchmark your profile confidentially.

5 Signs You’re Ready to Move from IB to M&A Advisory

Introduction

After years in investment banking, the move to advisory or M&A consulting might feel natural—but timing and preparation matter.

1. You crave strategic partnership

If you prefer solving client problems end-to-end (not just closing deals), M&A advisory offers a deeper strategic role.

2. You’ve built cross-sector exposure

IB work across sectors—tech, pharma, FMCG—sharpens your insight. Good advisory teams value this commercial blend.

3. You’ve developed client relationship skills

Advisory demands client management: pitching, executing, aftercare. If you’ve led junior bankers and engaged clients directly, you're building needed soft skills.

4. You’re comfortable with selling

In advisory, winning mandates is as important as delivering deals. If you enjoy pitchbooks, strategic storytelling, and networking—you’re suited for this.

5. You see M&A as a long‑term career

Where IB is often a stepping stone, advisory provides durable career paths—partner tracks, sector-specialist roles—and the satisfaction of guiding clients repeatedly.

Conclusion

Advisory isn’t just another step—it’s building ownership of deal strategy and client trust. Ready to talk transition paths or practice advisory-case frameworks? Reach out—we’d be happy to help your move.

Corporate Development vs Investment Banking Which Path Suits You?

Introduction

Many candidates debate IB vs Corp Dev. Both centre on strategy and transactions—but the day-to-day and long-term career arcs are quite different.

1. Deal cycle & pace

IB: fast, client-driven, high-pressure; Corp Dev: deeper deals, multi-year strategic shifts. Think startup-style acquisitions vs debt/equity markets.

2. Stakeholder proximity

In IB you pitch externally; Corp Dev means working day-to-day with C-suite, executing post-merger integration, and internal stakeholder management.

3. Broader strategic remit

Corp Dev involves divestitures, JV partnerships, investment thesis, corporate innovation—beyond classic sell-side/buy-side.

4. Skillsets and culture

IB hires often use technical chops; Corp Dev favours strategic thinkers who can navigate internal politics and cross-functional collaboration.

5. Career progression

IB leads to front-office PE or senior banker roles; Corp Dev feeds into general management, strategy, operations or CEO-track positions.

Conclusion

If you’re advisory-driven and prefer embedded strategic roles, Corp Dev may be a better cultural fit. At Circle Square, we support both paths—with tailored briefings, interview prep, and firm insights.